FAMGA. That shiny metal. Satoshis. Static vs. Dynamic. Paralysis

*This is NOT investment advice, it’s merely thoughtful pondering.*

During such unfamiliar times, where is the smart money going? The right question should be, where is the wise money going?

Here are the big themes we’re seeing right now:

1- Flight-to-Quality: i.e. Invest in the equity/debt of companies with strong balance sheets and diversified revenue sources, buy government securities, hold cash in USD, buy gold, buy BTC.

2- Opportunistic: i.e. Invest in distressed debt, convertible bonds, options, distressed real estate.

I’m going to focus on the first theme, as the second requires specific skills, connections, and comprehension (many of which I lack). To be clear, I’m talking about choosing investments- not trading. While trading relies on charts, investing relies on the quality of life (QoL).

Think of every success story in history. What is a single factor of success we can attribute to all of them? Has it been the result of strong balance sheets, or branding, or government support? No, those factors may have helped (in some cases a lot), but taken in isolation cannot be the reason. The common denominator seems to be increasing the quality of life for people.

Consider some of the most successful companies in the world today: Apple, Microsoft, Amazon, Google. We could dig into their fundamentals, study their stock charts, interview management, execute comparative/historical/macro/micro analyses, work at the companies, own the companies and we’ll come up with lots of retrospective reasons for their success. But the one thing I can say confidently without looking into any of that, is that each company contributed significantly to the quality of people’s lives.

Apple revolutionized consumer tech in practicality, design, and functionality. Microsoft revolutionized the computing industry with software, making every little task done on a computer simply simpler, Amazon brought the world to your doorstep, or kindle, or TV. Google is your know-it-all aggregator of anything and everything. Each company decreased the time wasted on menial inefficiencies, and opened up new worlds of optionality for us. Today each company offers a vast array of products and services as they continuously expand into new verticals, pushing QoL higher with every success.

Now this is the question to ask yourself – what assets/companies/industries will continue to upgrade the quality of life during and after this crisis? While this question may have a lot of embedded complexity, it ultimately simplifies our process of analysis.

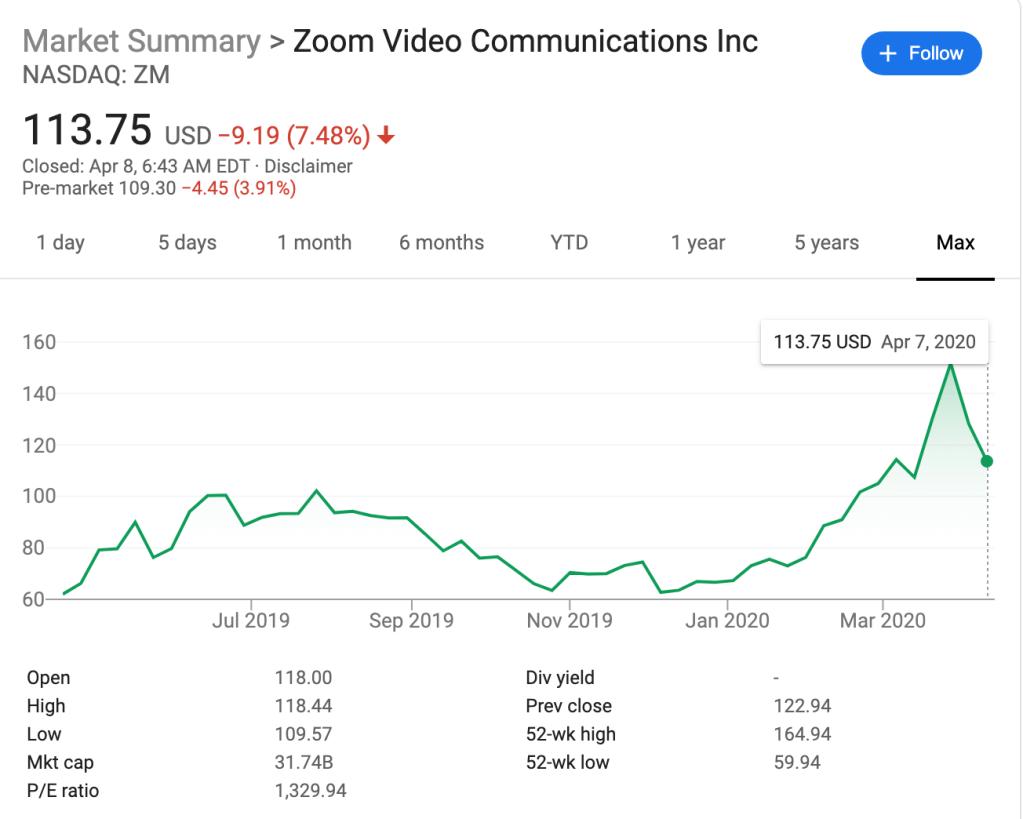

Let’s take Zoom as an example.

Zoom was established in 2011 by an ex-Cisco employee (Eric Yuan) who dreamed of a better WebEx (Cisco’s video-conferencing tool). At the time, video-conferencing tools were fragmented, unreliable, and expensive- they weren’t for anyone, and that severely limited their use. Zoom built features and products that integrate all devices (including the older expensive conference tools) adding webinars, break-out rooms, screen-sharing, transcribing and so much more.

Today, Zoom leads the industry boasting north of 13 million active users with over 2.3 million added in 2020 alone so far. We did have other options though, it seems to be a very simple tool, doesn’t seem ground-breaking, so what is it about Zoom? Quality. Zoom focused on increasing the quality of our lives through reliability, interoperability, and functionality – all while being frugal with plenty of funding.

Funding is essential. A good idea without funding is just that, a good idea.

Zoom has clearly been an excellent investment, but it’s ability and willingness to continue to operate, enhance, and innovate will determine if it still is going forward. Zoom’s ambitions is to not just become the best video conferencing tool anymore, but to become a full blown virtual office (with live translations, desk phone replacements, optimizing office collaboration, etc) as well as virtual classes. In order to achieve their ambitions they need the right leadership and funding- can they manage not just propose to upgrade QoL? So ask yourself, will it continue to upgrade the quality of our lives?

Zoom’s video quality was optimized to work well from any device, no matter how many people plugged in. This was vital in capturing the market, especially during the coronavirus pandemic. No one cared about its fundamentals or stock charts, they just flocked to quality. Now webinars, conferences, meetings, and just one-on-one chats can all be taken from one program that easily integrates with other programs and hardware- and you can trust it will work.

If you want to hear more about Zoom’s story, I found a nice description of it here.

“My own success has been in observing objects in daily use which, it was always assumed, could not be improved.”

James Dyson

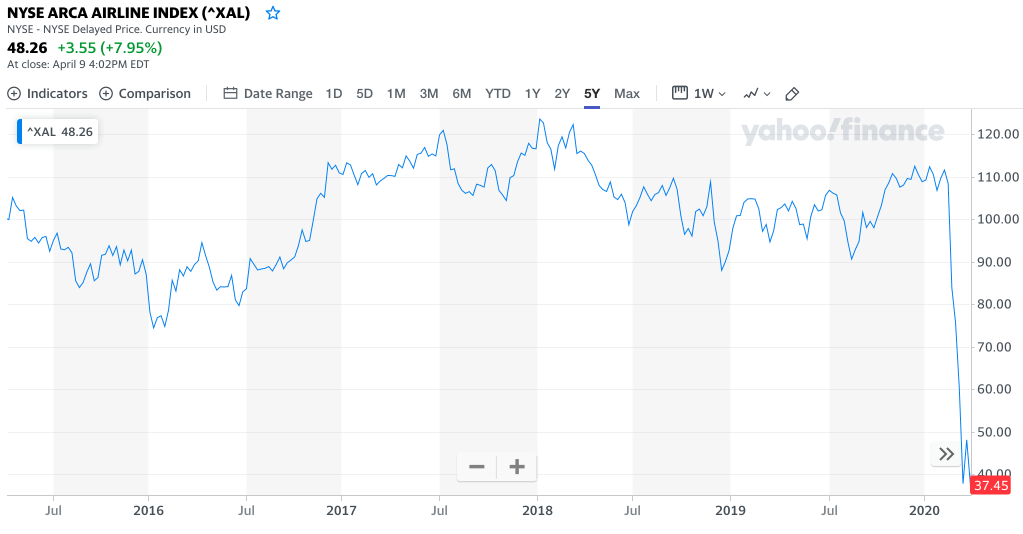

What about legacy industries?

One of the hardest hit industries from coronavirus is the Airline industry. With airports shut down and fear of contamination, we can expect it will take a while to go back to normal, if it ever does. Because of this, airline stocks have tumbled and buying them has never been cheaper.

Here’s how I would think of this:

1- Is the business sustainable? Are they able to continue to operate (will people travel)? How much debt does the company hold? What are their chances of paying it or refinancing, or getting bailed out (unfortunately, this is a real option)? Basically, will they survive the next year or two?

2- How will they adapt to the “new norm”? Here’s where it gets interesting. Airlines compete on providing the best quality service for your buck. To the customer, that would mean offering the most comfortable travel experience. In the past, this has been translated as seat comfort, food, service, pricing, routes, timing and delays, miles, upgrades, ambience, etc. Now we need to consider does our definition of comfort change or evolve at all after this? My guess is yes.

While I agree with Balaji in the short-term, I don’t think in this day and age we can assume that people will not be travelling at all anymore. People have been travelling in one way or another since the beginning of time. To me, that culture has been set and is not reversible. But it definitely can evolve- they might search for a new way to travel all together (and not just through VR, though VR will definitely have its place). Assuming commercial planes continue to be our default though, people will want a more spread out seating arrangement in the plane, proper attention to hygiene (from crew and passengers alike), proper health screening measures (but not in a way that causes too much inconvenience), and better onboard health services in general. And this is just the bare minimum to survive, they’ll have to get creative if they want to truly succeed. While this will cost the airline companies to transform into, it will also force them to find new ways to compete and eventually new revenue streams. If they survive this pandemic, that is.

So here are the major questions to consider with any investment:

1- Does the idea increase QoL?

2- Is there proper leadership/management to sustain the idea?

3- Is there proper funding to sustain the idea?

Obviously there will be other miscellaneous factors to consider, and these questions apply to all types of investments, therefore the details and risk/return characteristics will vastly differ. But in a time like this where you seek quality above all else, the priority metric should be QoL.

It’s easy to determine QoL effects on a bright and known future, it’s much harder to determine QoL effects with uncertainty (i.e. reality), it is also more important to. So determining QoL effects will depend on your assumption of the uncertain future, it is not foolproof. QoL simplifies the process of analysis, but doesn’t necessarily make it easy. There is a lot of subjectivity, and it’s up to you to try to stay as objective as possible and to look at it with as wide a lense as possible. Not an easy task.

Let’s take a crack at formulating it.

The most important factor in measuring QoL is time. So far we’ve been living finite lives, so time for us is limited. The quality of our lives increases as we spend less time on surviving and more time on doing what we like, so time is the measurement we can use to approximate QoL. How much time will this product/service save me?

It’s not always a direct analysis though, you must think beyond first-order consequences. If something seems to increase my QoL by saving me time today, yet costing me more than I can handle resulting in difficulties later on, that could lower my QoL below its current level. Eating a Big Mac everyday can make me happy as it saves me time cooking and deciding, but could cause health risks in the future that rob me of my money and time for leisure. We can go further and see that something may save you time today, but take time away from others, which could backfire (like a business that saves you time by relying on inhumane labor practices that are unsustainable). There’s really no limit to how far we can go with this. Point is, cost is already baked into the QoL metric as long as you look at the QoL trend, not just QoL as a single point. Lots of factors are baked into it, that’s the subtle beauty it possesses. A formula could look something like this:

QoL increases = time saved + costs reduced + health improved + benefit to society + … + …

Where the number and description of factors is anyone’s guess. Which, of course, means there is no one formula for QoL. We could alternatively look at it like this:

QoL increases = time saved (keeping all other things constant)

Notice that QoL is an increment, as in the upgrade to QoL is what we want to know. When looking specifically at investments, you of course want those that target an upgrade of QoL to the largest group of people. In each case, the formula is whatever makes sense to you, so for me, time is the easiest general measure to start with. People who are serious about formulas may not be happy with this 🙂

Let’s take Bitcoin as an example as many may not realize its effect on QoL.

Bitcoin is a decentralized network with its own cryptocurrency (BTC), with scarce supply capped at 21 million units, that runs on blockchain technology. A cryptocurrency is a digital currency using cryptography for verification and security. It was introduced to the world in 2008 by God-knows-who going by the name of Satoshi Nakomoto. He/she/they (it) released a white paper explaining the idea, created (or mined) the first BTCs, and unleashed it to the world. Most of you know what happened next.

If you want to learn the details of how Bitcoin works, this video describes it well.

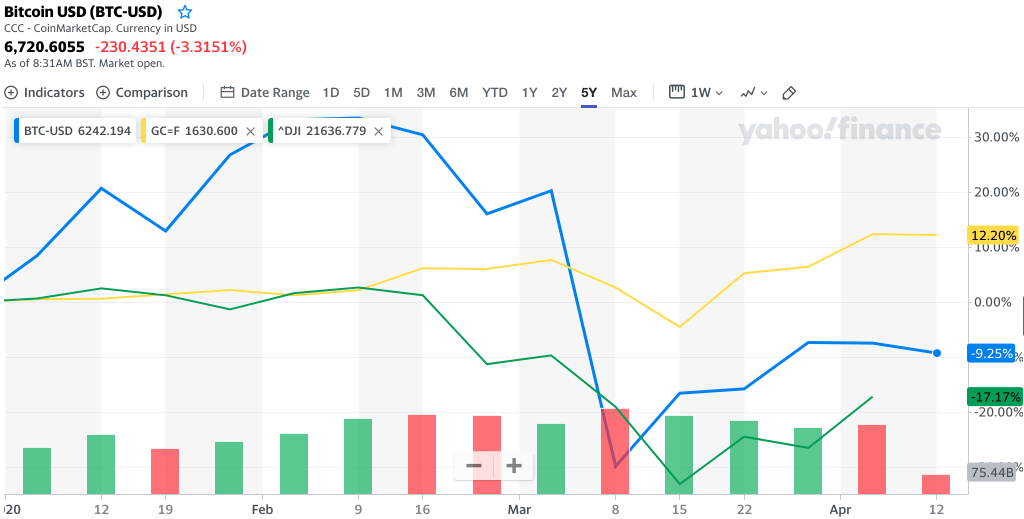

Looking at a chart showing the price of BTC, gold, and the Dow Jones since the beginning of this year reveals that gold apparently was the best place to park your money over the last 3 months. This makes sense, as gold is considered a global store of value, and the time for it to shine is during a crisis. Actually, it shines all the time. If this weren’t the case, people will be disincentivized to invest in gold as holding USD would be easier (unless they’re obsessed with its beauty, like me). Since the beginning of this century, the world has experienced 3 major market crashes (2000 dotcom bubble, 2008 financial crisis, 2020 coronavirus pandemic) and each crash increases our fear and awareness of future crashes, so after every crisis people look more and more towards gold as a store of value outside of the financial system (which is the first to get hit in a crisis). Coupled with the fact that it is scarce, gold has been on a strong trajectory upward.

But let’s zoom out a bit since we’re discussing quality of life not quality of moment.

This chart seems dysfunctional, as the Dow Jones and gold are just straight lines at the very bottom. This is, in fact, a linear graph with percent return on the y-axis – exactly the same as the one above. Bitcoin’s performance over the last 5 years compared to the other two is literally on another league that the performance of gold and the Dow Jones is relatively negligible.

Now obviously “past performance is not indicative of future results”, and we can go on and on forever debating the details of BTC and why it performed so well, but that is not our goal here. Here we want to focus on how BTC fits into the QoL model, and how that could have positioned you to benefit from the incredible performance seen above.

So if we consider the questions we should ask ourselves: does BTC increase QoL?? Remember that formula? Does owning BTC save me time in any way? BTC is an alternative to both gold and the USD (or any other government-backed currency aka fiat). It proposes to be the most secure way to transfer value digitally on the internet (the largest market in the world), and so far it hasn’t failed. Considering how quickly and easily you can own and transfer BTC relative to wiring funds through a bank account, it definitely upgrades QoL. An important factor to include is the increase in security BTC offers, security of funds online that is. Gold is hard to mine, store, transfer, divide and collect. BTC is like “digital gold” where we have the same benefits as gold mentioned earlier (plus a lot more) without its physical barriers. There are lots of factors we can include in BTC’s upgrade to QoL, but again that’s a very long and separate conversation.

Does it have proper management/leadership? BTC the currency is the output of Bitcoin the network. To avoid confusion, consider BTC the USD, while the underlying network (Bitcoin) is the Federal Reserve. Now just like commercial banks can be built on top of a Central Bank’s platform, countless applications can be built on the Bitcoin network using its robust security and ledger system. The key here is that unlike Central Banks who are run by governors for the government of a nation, Bitcoin is decentralized and open-sourced – no one owns it, it runs for the sake of the users of its network, and anyone can be a user. For BTC, we’ll have to evaluate its decentralized governance protocol to see if it incentivizes the protection and upgrade to QoL. Does it have proper funding? Here you look to see if enough people are investing in the mines, nodes, exchanges, wallets and everything that make up the infrastructure of the Bitcoin network. You also have to consider how many people are invested in BTC to make sure it is a liquid enough and sustainable market.

Beware your biases when analyzing QoL effects. It may often result in your cognitive biases taking over and fitting the explanation to your preconceived prophecy (I am often a victim of that myself, this whole post could be Exhibit A). For example, people may avoid investing in virtual reality because they hate the virtual and the implication of living life through a screen. They feel it takes away from life’s natural beauty. If they ask themselves the right questions, they’d see they could be missing out on a huge opportunity. You don’t have to agree to living life through a screen, but if you could wear a VR headset and watch a football game live as if you are in the stadium itself, would you prefer a Samsung flat screen instead? If you could watch any live event that you had no access to anyway, and feel like you are there, will you resist? Even if you are the most stubborn luddite, you must see how it increases QoL for the majority of people – which is what we should be considering. This is a discussion on perspective, which we will look into in the near future.

There are good investments that seem not to fit the QoL model, like tobacco companies. Over the long-term tobacco causes significant health defects, yet it had been an excellent investment for decades. Tobacco was a good investment in the past because people were unaware of its long-term destruction of QoL, they only saw the short-term satisfaction it brought them. Don’t forget you are dealing with markets, you must consider what the majority thinks. Today, more people are health-conscious and smoking continues to decline, so it seems the industry is reverting to its QoL value. If you’re going against the tide, make sure you consider the time needed for your views to unfold. Some smokers who are aware of the risks value the joy of a cigarette today more than the length of their life, to them time lost in the future as a result of smoking is time well spent. Enterprises built on a “cult” product (like cigarettes and coca-cola) can defy QoL for a while, but time will eventually force them to submit.

The best thing about QoL? You can apply it to any investment, both public and private markets alike. The metric is exactly the same, and now you’re comparing red and green apples, rather than being silly and using oranges 🙂

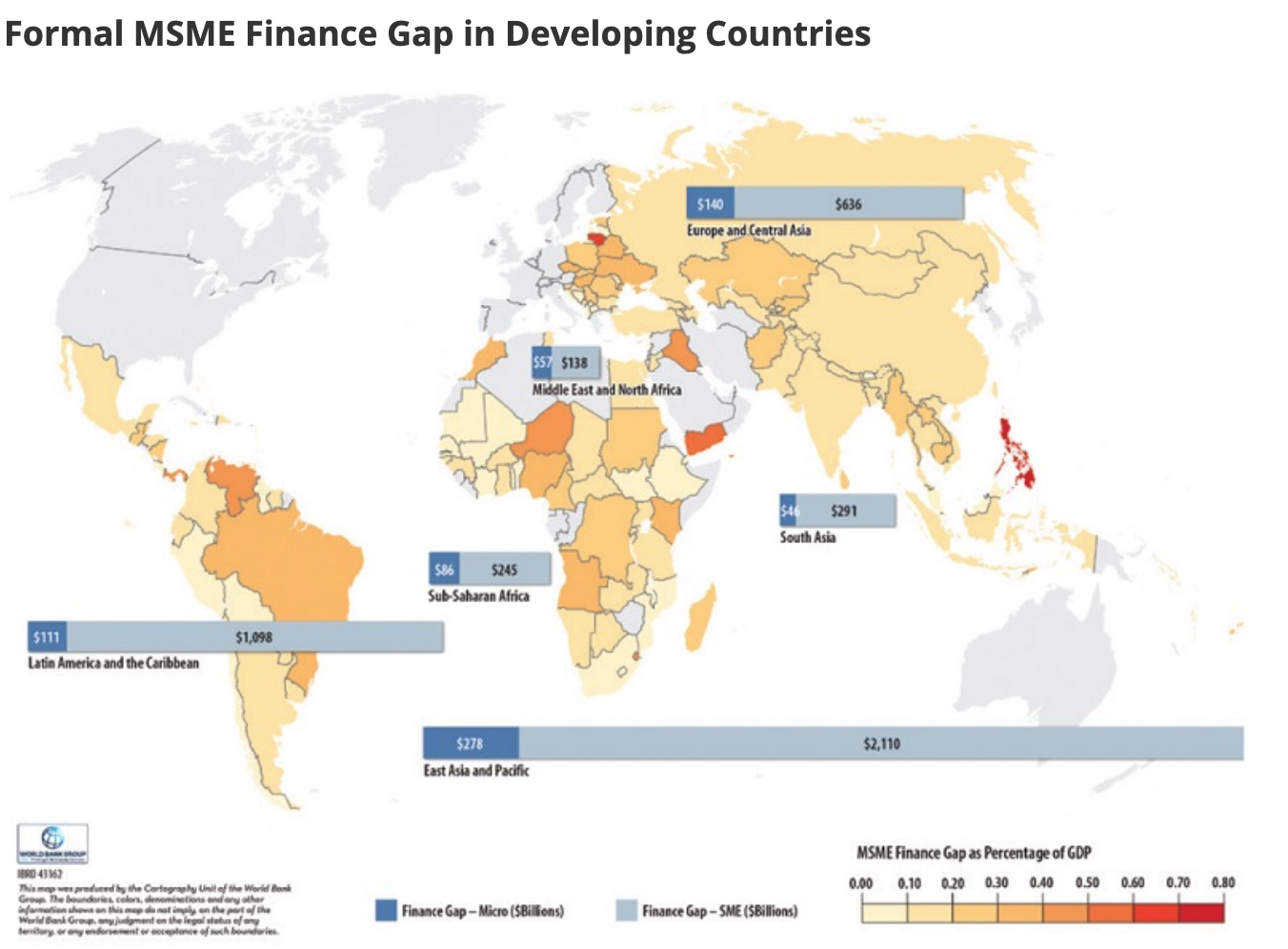

Notice so far we’ve only discussed public market assets. That’s only half the equation though, for before anything was public it had a long and fruitful history in the private markets.

The private markets, where most of a company’s growth and value creation is captured, are mainly split between private equity (established companies) and venture capital (startups). I worked in the KIA Hedge Fund department for 5 years, and now I’m completely focused on Venture Capital- there is a stark difference in how investments are evaluated. The metrics used in hedge fund investing (sharpe ratio, beta, maximum drawdown, standard deviation, alpha) are completely foreign to venture capitalists (who look at ARR, CAC, GMV, MoM growth); and vice versa.

This makes sense as public and private markets are two completely different realms. However, the private market is much larger and returns in venture capital are the type that literally change a person’s life – yet most people have 0 exposure to it. Why is that? The VC industry is highly opaque and inaccessible to the average person, and has been branded “high-risk” so much so that most people would rather avoid it than “take the risk”, as well as the returns that come with it. Also, most just don’t understand it because they try relating it to public market investments.

Lately, opportunities have been opening up for investors to gain access to private deals (hint: Republic.co), so let’s look at them through a QoL lense. To evaluate a startup investment using QoL, you apply the exact same questions we used with public market securities. So if someone knows how to use it with public securities, they already know how to apply it to private investments! Finally, a common language.

Using Careem (a UAE ride-sharing application) as an example, did the idea increase QoL? Considering the poor state of public transportation in the MENA region and the fact that you need a car to get around, definitely. Did it have the right founders/managers? We would have had to evaluate Mudassir Sheikha and Magnus Olsson on their capabilities to navigate the regional regulatory landscape as well as build a strong company that offers excellent service. In retrospect, we know those who believed in them were right to have done so. Did it have enough funding? Before you invest you need to consider how much has been invested already as well as how much more they’ll need to execute their vision. If you’re the only investor that’s not a great sign (although in rare occasions you can get lucky), and may mean they won’t have sufficient capital to execute. Careem, however, had no trouble fundraising before eventually selling for $3.1 billion to Uber. Of course should we attempt to evaluate Careem/Uber today with the coronavirus shaking things up, it would be a different story.

$100,000 invested in Careem in December 2016 would have been worth $310,000 by March 2019. To put it in perspective, the same amount invested in the S&P500 (SPX) would have been about $130,000 by March 2019. Careem of course is a great success story, and most startup investments you make won’t be. But without the exposure, you have no chance for the return. And without funding, these startups will never see the light of day and we lose the upgrades to QoL they could have contributed to. So funding startups should never stop. Because it’s the startups that deliver the biggest changes to the world and upgrades to QoL. This is something people should not forget in today’s environment- avoiding exposure to private investments is not the solution, funding the right ones could be. One successful startup investment can make up for 10s or 100s of failures. Sure they’re less liquid, but that illiquidity forces people to commit to long-term investing, and long-term investing is essential for QoL upgrades.

Having a single metric to evaluate all your investments helps you better allocate your capital across different asset classes. This is a time to look for quality assets, a time of flight-to-QoL, a time to set your investment strategies to look for and fund the most probable and effective QoL upgrades, wherever they may come from. We have to avoid paralysis resulting from an onslaught of advice, confusion and fear. The opportunistic investments mentioned in the beginning can be evaluated using QoL as well. Pretty much any important decision can. It may seem like an obvious idea, but most people get too obsessed with other metrics, that they fail to recognize the most important one. The example analyses above are extremely simplified for the sake of this post, and of course in each example there are many other considerations to take. In most cases though, those considerations can be linked back to QoL. To state the obvious, ideas need to actually work to upgrade QoL, they need to be practical.

Humans always yearn for a higher quality of life, it’s that human nature thing again. It so happens to be that markets are more natural than we think. Ignoring economic theory for a second, assets seem to follow the same trajectory as the humans who funded them- continuously searching for a higher QoL.

This is why in the beginning I said we should follow the wise money. Smart money is static, it tells you where the fish is; wise money, on the other hand, is more dynamic, it teaches you how to fish. Wise money targets the QoL, and QoL is long-term by nature.

So look to those investments that enhance QoL. But in seeking a higher quality of life, we must not forget to target it both extrinsically and intrinsically. For the inner quality of your life is something only you can enhance.

“You have power over your mind- not outside events. Realize this, and you will find strength.

Marcus Aurelius

Disclosure: This is not science.

Full disclosure: I may be completely wrong in areas, and possibly am so don’t take this too seriously. This is the philosophy I’m applying to my investments.

X-ray disclosure: I really just wanted to finish this post and move on.

One thought on “Flight to Quality-of-Life”